One of my favorite resources that we offer at Values-Driven is the Excel Budget Workbook, part of the Home Management Bundle. This tool was a labor of love prepared by yours truly (Marc) many moons ago. I happen to be an Excel guru and so, when I could not find commercially-available budget software that did what I wanted it to do—I made one! The more I got into it, the more features were added. Then a couple friends of ours had financial management woes and I decided to universalize the tool for anyone to use.

For those of you who’ve downloaded this workbook, let’s go through the many features of the tool that will help you and your family be better stewards with the resources God has entrusted to you. First, let’s understand the basic premise behind the tool. This is not your average budget; instead, we created and use it as part of our household stewardship paradigm. If you are a cash (non-credit) family, you’ll understand perfectly how it works.

The Excel program works as an annual budget, essentially putting money in “buckets” so that if we do not spend the allowed monthly amount in a given category, we have some left over for the remaining months of the year. Conversely, if we overspend, it reduces the allotment for that category evenly for the remainder of the year. Everything is designed to balance for the year—and the fiscal year can start on whatever month you choose. (We use calendar year, personally.) The tool allows you to spend according to a cash-like system using the payment option of your choice—cash, check, or credit.

The average budget is designed for planning but does little for stewardship (in other words, it is difficult to see how you are tracking with your plan). In our experience, most budget-users (unless they use cash exclusively or check exclusively) end up just doing a post-mortem review at the end of the month and hope they did well. Being a professional project manager and an instructor in the discipline, that was not good enough for me. What is the point of planning if you can’t ensure that you are tracking to plan and will end on plan? Useless! So I designed a tool for real-time tracking and one that allows for iteration (making changes on the fly). It’s all in there.

However, for it to work effectively (and this is usually the hard part!), both spouses must save receipts and input the data into the workbook ledger in real-time. This is what creates accountability to the spending plan. Otherwise, the budget will do nothing except put some great theoretical numbers on paper. Both spouses must agree up front on the spending plan and live by it. Pray it up and get the Lord’s concurrence on where your resources should go. If you’re over-extended in one category on month A, you can always “rob Peter to pay Paul” so that the overall budget balances for that month, but the idea is to stick to the overall spending plan. In this way, all of your spending, giving, and saving objectives will be met.

This is where good communication is key, both when developing your budget figures and when inputting the information on a daily or weekly basis. Decide who’s going to do the tracking—one or both of you? Where will receipts be kept? Will one of you be primarily responsible for spending in each category? For example, we have categories for school and houseware expenses, which are primarily Cindy’s responsibility; I, on the other hand, usually fill out the auto maintenance and yard & garden categories. If one of us plans on making a purchase in the other’s “usual” domain, we just make sure to double-check the current budget inputs and talk about it first. This eliminates confusion.

Let’s move on to the details. (Most of the guidance below is listed in one form or another in the “user’s guide” tab [red] at the bottom of the workbook.)

Perhaps obviously, it all starts with setting your income and expense categories.

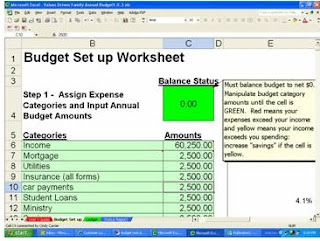

1. Go to the “budget setup” tab (yellow). Start by putting in your income. We put annual take home pay and estimates for other sources (rental income and product sales). Be sure to use 52 checks for weekly paycheck employees and 26 for bi-weekly. Otherwise, it won’t add up correctly. This is what you have to spend. The tool will split the income up evenly for the 12 months, knowing full well that most months have 2 or 4 paychecks and a few have “extras,” or for you self-employed, income is less predictable altogether.

1. Go to the “budget setup” tab (yellow). Start by putting in your income. We put annual take home pay and estimates for other sources (rental income and product sales). Be sure to use 52 checks for weekly paycheck employees and 26 for bi-weekly. Otherwise, it won’t add up correctly. This is what you have to spend. The tool will split the income up evenly for the 12 months, knowing full well that most months have 2 or 4 paychecks and a few have “extras,” or for you self-employed, income is less predictable altogether.

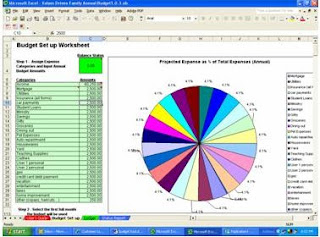

2. To set your spending categories, review your bills and capture all the places your money normally goes. You will probably have to “lump,” that is, put common categories together to limit it to the 25 category spaces in the budget tool. For example, we lump all insurances (life, homeowners, auto) into one category called—you guessed it—insurance. We also lump all utilities. You get the picture. Our exhaustive list of how we lump is what you will find in the default settings of the tool. You can overwrite that text to suit your needs. You’ll see we list ministry as a category, gifts as a category, and savings as a category. Debt reduction is also a good category (beyond the payment amount). If you do not capture these up front in your plan, (figuring you’ll just save “what you have left over,”) it won’t happen! So plan your savings and debt reduction.

3. Next, input your total annual spending for each category. For accurate estimates, you’ll probably want to look over your past year’s bills, by reviewing old bills, credit card/bank statements, or your check register. Once you input annual amounts, the tool will evenly split your spending among the 12 months. It will compensate (and so should you) for those occasional payments (like fuel-oil) that are intermittent, bills that are quarterly or semi-annual, etc. This is your final spending plan.

4. Before you can use the tool, you have to make sure the budget balances. The little box on the setup worksheet labeled “budget status” must be green! If it is yellow, increase savings or another spending category. If it is red, you need more income or must reduce amounts in some of the discretionary categories. If you can’t get out of the red, you’re in trouble and I can’t help you! You must either increase your income (second job, better job, etc.) or reduce spending (more affordable housing or vehicle, debt consolidation, etc.).

4. Before you can use the tool, you have to make sure the budget balances. The little box on the setup worksheet labeled “budget status” must be green! If it is yellow, increase savings or another spending category. If it is red, you need more income or must reduce amounts in some of the discretionary categories. If you can’t get out of the red, you’re in trouble and I can’t help you! You must either increase your income (second job, better job, etc.) or reduce spending (more affordable housing or vehicle, debt consolidation, etc.).

5. Now to use the tool. Here is where ours and the rest diverge. Go to the “ledger” tab (green). This looks sort of like a check register with all your spending categories itemized by month. As you spend, put the data in. Weekly tends to work for us. Daily is better. Monthly is BAD!!! Don’t do it. Because if you wait until the end of the month, you may have already overspent. Again, this is a stewardship tool, not just a planning tool.

5. Now to use the tool. Here is where ours and the rest diverge. Go to the “ledger” tab (green). This looks sort of like a check register with all your spending categories itemized by month. As you spend, put the data in. Weekly tends to work for us. Daily is better. Monthly is BAD!!! Don’t do it. Because if you wait until the end of the month, you may have already overspent. Again, this is a stewardship tool, not just a planning tool.

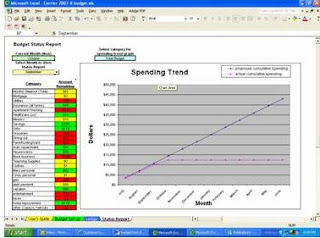

6. As you input data in you ledger, go to the “status report” tab (blue) and see where you stand. Select the current month. If you are in the green, you have money left in the pot; yellow, less than 10% left; red, overspent! The status report also tells you how much you have left for the total budget and per category. Lastly, you can see how you are tracking visually per category using the graph. Just select the category you want in the pick menu and—voila!—a graph. You want the red line to remain below the blue line on this graph, especially for the total budget!

6. As you input data in you ledger, go to the “status report” tab (blue) and see where you stand. Select the current month. If you are in the green, you have money left in the pot; yellow, less than 10% left; red, overspent! The status report also tells you how much you have left for the total budget and per category. Lastly, you can see how you are tracking visually per category using the graph. Just select the category you want in the pick menu and—voila!—a graph. You want the red line to remain below the blue line on this graph, especially for the total budget!

Here are some tips from the trenches. The goal is to remain on plan per category. However, that is not realistic since spending is sporadic for most categories (except maybe loan payments such as a mortgage). Utilities fluctuate; car repairs are entirely unpredictable, etc. So you have two things to monitor—how you are tracking per category, and more importantly, how you are tracking for the TOTAL BUDGET for the month. If you have an expensive car repair that eats up your entire annual car repair budget, you better spend lightly on all the other discretionary categories so that you track per plan for the total budget for the month. If you have no other major car repairs for the year, you will still track per plan for that category. But the key is making sure you have enough money to cover your spending for that given month.

I think I covered all the major features. If you have any other questions or notice something important I missed, comment and I will comment in return so everyone can benefit from it.

God bless you,

Marc